Strong demand for Alkyl Ketene Dimer in paper and packaging will drive prices in 2025. Companies seeking growth must track market shifts and pricing factors.

- The market is projected to reach USD 375.9 million in 2025.

- CAGR is estimated at 5.1% from 2025 to 2032.

| Key Factors Influencing Prices | Description |

|---|---|

| Demand for Paper and Paperboard Products | Rising demand pushes prices higher. |

| Technological Innovations | New processes can shift supply and pricing. |

| Environmental Regulations | Stricter rules may raise production costs and prices. |

Amazon Chemicals delivers trusted insights and reliable supply. Companies can contact Amazon Chemicals for tailored solutions.

Price Outlook 2025

Market Size and Growth

The Alkyl Ketene Dimer market continues to expand as industries seek advanced solutions for paper and packaging. Market analysts project the global value to reach USD 375.9 million in 2025, with a compound annual growth rate (CAGR) of 5.1% through 2032. This upward trend reflects strong momentum in both developed and emerging economies.

Several factors drive this growth:

- Global shift toward alkaline papermaking methods

- Rising demand for high-quality printing and packaging paper

- Increasing use of recycled fiber in paper production

- Operational and environmental advantages of Alkyl Ketene Dimer over traditional sizing agents

- Technical advancements in product formulation

- Investments in pulp and paper manufacturing capacity

- Expansion of the paper packaging industry due to sustainability bans on plastic packaging

- Increased demand for coated paper and paperboards

- Surge in packaged goods requiring laminated paper

- Growth fueled by e-commerce penetration

- Alkyl Ketene Dimer’s role in enhancing strength, stability, and quality of paper products

- Higher demand for premium paper grades sized with Alkyl Ketene Dimer

Companies that recognize these drivers position themselves for success in a competitive market. They benefit from improved product quality and greater operational efficiency.

Short-Term vs. Long-Term Trends

Short-term price movements for Alkyl Ketene Dimer often respond to fluctuations in raw material costs and seasonal demand spikes. Manufacturers adjust production schedules to meet urgent orders, which can cause temporary price increases. In the near term, supply chain disruptions and regulatory changes may also influence pricing.

Long-term trends show a steady rise in demand, supported by ongoing investments in technology and capacity. The integration of advanced technologies transforms the Alkyl Ketene Dimer market, enhancing research and development. Changing consumer preferences drive the need for more agile and responsive market strategies. The rise of hybrid research models enables businesses to understand consumer behavior across regions, supporting sustainable growth.

| Trend Type | Key Features | Impact on Price |

|---|---|---|

| Short-Term | Raw material volatility, seasonal demand | Temporary fluctuations |

| Long-Term | Tech innovation, sustainability, market growth | Steady upward movement |

Manufacturers and buyers who monitor both short-term and long-term trends gain a strategic advantage. They anticipate market shifts and secure better pricing for Alkyl Ketene Dimer, ensuring business continuity and profitability.

Alkyl Ketene Dimer Market Drivers

Paper Industry Demand

Industrial development in the paper and packaging sectors continues to fuel the need for Alkyl Ketene Dimer. Companies in these industries seek to improve the quality and versatility of their paper products. Alkyl Ketene Dimer offers a reliable solution for enhancing paper strength and water resistance. As a result, manufacturers choose this sizing agent to meet the growing requirements of high-performance paper.

- The Alkyl Ketene Dimer market reached a value of USD 1.2 billion in 2024.

- Projections show the market will climb to USD 1.8 billion by 2033.

- The compound annual growth rate (CAGR) stands at 5.0% from 2026 to 2033.

Companies that invest in Alkyl Ketene Dimer gain a competitive edge in the fast-evolving paper industry. They deliver products that meet customer expectations for quality and durability.

Sustainability Trends

Sustainability shapes the future of the Alkyl Ketene Dimer market. Environmental regulations push companies to adopt eco-friendly practices. Consumers now demand biodegradable and recyclable products. Alkyl Ketene Dimer stands out as a sustainable alternative to traditional chemicals.

- Sustainability trends drive demand for eco-friendly and biodegradable products.

- Companies innovate production processes to create sustainable alternatives.

- Meeting regulatory standards and consumer preferences becomes essential for market success.

Businesses that embrace sustainability not only comply with regulations but also build trust with environmentally conscious customers.

Regional Growth

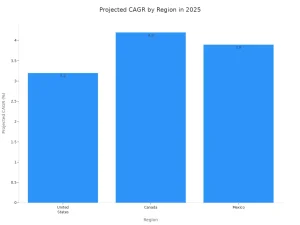

Regional markets show different growth rates for Alkyl Ketene Dimer consumption. North America leads with strong industrial activity and rising demand for high-quality paper. The United States, Canada, and Mexico each contribute to the market’s expansion.

| Region | Market Size (2024) | Projected CAGR (%) |

|---|---|---|

| United States | USD 113.05 million | 3.2 |

| Canada | USD 17.19 million | 4.2 |

| Mexico | USD 13.04 million | 3.9 |

Industrial growth and environmental regulations work together to shape the Alkyl Ketene Dimer market. Companies that respond to these drivers secure long-term growth and meet the evolving needs of the global paper industry.

Market Segmentation

By Type

Alkyl Ketene Dimer (AKD) comes in several forms, each serving unique industry needs. Companies can choose from different types based on performance and handling requirements. The table below highlights the main types and their market shares:

| Type of AKD Waxes | Market Share in 2023 | Key Applications |

|---|---|---|

| Medium Melt Index AKD Waxes | Over 40% | Paper coatings, adhesives, plastics |

| Low Molecular Weight AKD Waxes | Largest share | Papermaking, plastics, coatings |

| Prilled AKD Waxes | Over 40% | Ease of handling and storage, high melting point |

Medium melt index and prilled AKD waxes each hold over 40% of the market, while low molecular weight AKD waxes claim the largest share. Businesses that select the right type of AKD can optimize production and improve product quality. This choice leads to better performance in papermaking and related industries.

By Application

Alkyl Ketene Dimer finds use in a wide range of applications. Companies in the paper sector rely on AKD to enhance product features and meet customer demands. The following list shows the main areas where AKD drives value:

- Printing and Writing Papers: 40–42% of demand, boosting print quality and surface smoothness.

- Paperboards: 30–32% share, providing moisture resistance and surface strength for packaging.

- Newsprint: 18–20% consumption, improving press performance and ink adhesion.

- Other applications: 8–10% market share, including specialty and decorative papers.

Manufacturers who focus on these high-demand segments gain a competitive edge. They deliver superior paper products that stand out in the marketplace.

By Region

Regional trends shape the Alkyl Ketene Dimer market. Asia Pacific leads global consumption, holding about 36% of the market in 2021. Europe and North America follow as strong markets. The paper manufacturing industry in Asia Pacific continues to expand, driven by sustainable practices and recycling initiatives.

- Asia Pacific dominates global AKD consumption.

- Europe and North America remain key regions for growth.

- Sustainable papermaking in Asia Pacific fuels ongoing demand.

Companies that target these regions position themselves for long-term success. They tap into growing markets and respond to evolving industry standards.

Supply and Demand

Production Capacity

Manufacturers continue to expand Alkyl Ketene Dimer production capacity to meet rising market demand. Leading producers invest in new facilities and upgrade existing plants. These actions increase output and improve efficiency. Companies in Asia Pacific, Europe, and North America focus on scaling operations. They aim to reduce costs and deliver consistent quality.

| Region | Major Producers | Capacity Growth (2025) |

|---|---|---|

| Asia Pacific | China, India | +8% |

| Europe | Germany, Finland | +5% |

| North America | United States, Canada | +4% |

Increased production capacity strengthens supply reliability. Buyers gain confidence in securing steady shipments for their operations.

Trade Flows

Global trade flows shape Alkyl Ketene Dimer availability and pricing. Exporters in Asia Pacific supply large volumes to Europe and North America. Importers in these regions rely on stable shipments to maintain inventory. Trade agreements and logistics improvements support smoother transactions. Companies monitor tariffs and shipping costs to optimize procurement strategies.

- Asia Pacific exports account for 38% of global trade.

- Europe imports 27% of total volume.

- North America receives 22% of shipments.

Supply chain managers track trade flows to anticipate market changes. They adjust sourcing plans to avoid disruptions and capitalize on favorable pricing.

Inventory Trends

Inventory management plays a critical role in Alkyl Ketene Dimer market stability. Producers maintain moderate stock levels to balance supply and demand. Distributors use advanced tracking systems to monitor inventory turnover. Seasonal demand spikes prompt companies to increase safety stocks.

| Inventory Strategy | Benefit |

|---|---|

| Just-in-Time | Reduces holding costs |

| Safety Stock | Prevents shortages |

| Automated Tracking | Improves visibility |

Smart inventory practices help businesses avoid shortages and price volatility. Companies that partner with reliable suppliers like Amazon Chemicals secure consistent access to Alkyl Ketene Dimer and maintain operational efficiency.

Competitive Landscape

Key Players

Several companies lead the Alkyl Ketene Dimer market. These organizations invest in research, expand production, and build strong distribution networks. Key players include:

- Kemira Oyj

- Solenis LLC

- BASF SE

- Seiko PMC Corporation

- Amazon Chemicals

Each company brings unique strengths. Some focus on innovation, while others prioritize global reach. These leaders set industry standards and influence market trends.

Pricing Strategies

Companies use different pricing strategies to stay competitive. Many leaders offer volume discounts to large buyers. Some adjust prices based on raw material costs. Others introduce flexible contracts to attract new customers. The table below shows common pricing tactics:

| Strategy | Benefit |

|---|---|

| Volume Discounts | Encourages bulk purchases |

| Dynamic Pricing | Responds to market changes |

| Long-term Contracts | Secures customer loyalty |

| Value-added Services | Differentiates from competitors |

Smart pricing strategies help companies win market share and build lasting relationships with buyers.

Amazon Chemicals Role

Amazon Chemicals stands out as a trusted supplier in the Alkyl Ketene Dimer market. The company offers reliable delivery, technical support, and tailored solutions. Buyers choose Amazon Chemicals for consistent quality and responsive service. The team helps clients manage risks and optimize procurement. Companies that partner with Amazon Chemicals gain a competitive edge and secure their supply chain.

Contact Amazon Chemicals today to access market-leading products and expert guidance.

Challenges and Opportunities

Raw Material Volatility

Manufacturers face significant challenges from raw material price swings. The cost of fatty acids, a key ingredient in Alkyl Ketene Dimer production, often fluctuates due to global supply chain disruptions. When prices rise, production costs increase. Smaller paper mills, especially in developing regions, struggle to absorb these higher expenses. This situation can push market prices upward and limit access for some buyers. Companies that monitor raw material trends and secure reliable suppliers gain a clear advantage. They protect their margins and maintain steady operations despite market uncertainty.

Companies that invest in strategic sourcing and inventory management can reduce the impact of raw material volatility. They position themselves to respond quickly to market changes.

New Applications

The Alkyl Ketene Dimer market continues to evolve as new applications emerge. These innovations drive demand and open fresh opportunities for growth.

| Evidence Point | Description |

|---|---|

| Growth in Paper and Pulp Industry | Advancements in the sector boost AKD demand. |

| Regulatory Push for Eco-Friendly and Non-Toxic Sizing Agents | Eco-friendly trends promote AKD formulations. |

| Expansion of Packaging and Corrugated Board Segments | Growth in packaging supports increased AKD market penetration. |

| Shift Toward Alkaline Paper Making Processes | Alkaline processes enhance AKD compatibility. |

| Increased Adoption in Specialty and Security Papers | AKD finds new uses in specialty paper products. |

| Growth of Recycled Paper Processing | Efficient sizing systems favor AKD usage. |

| Regional Paper Mill Expansions in Asia-Pacific | Industrial growth in Asia-Pacific boosts bulk AKD consumption. |

Manufacturers who explore these new applications expand their market reach. They meet evolving customer needs and capture emerging segments. Companies that innovate with AKD formulations stand out in a competitive landscape.

Technology Advances

Technological progress shapes the future of Alkyl Ketene Dimer manufacturing. Research and development teams introduce improved formulations that enhance performance and reduce environmental impact. Modern AKD emulsions, stabilized with cationic starch or polymeric emulsifiers, offer better dispersion and storage stability.

- Advancements in AKD emulsion technology improve product efficacy.

- Enhanced shelf life and application consistency are achieved.

- Modern emulsions reduce agglomeration and improve resistance to microbial degradation.

Manufacturers who adopt these technologies deliver superior products. They build customer loyalty and strengthen their market position. Companies that invest in innovation lead the industry and set new standards for quality and sustainability.

Forward-thinking businesses seize opportunities by embracing new technologies and expanding into untapped markets. They secure long-term growth and resilience in a changing industry.

Buyer Insights

Procurement Tips

Buyers who want to secure Alkyl Ketene Dimer at the best value need a clear strategy. They should start by researching current market prices and tracking supply trends. Smart buyers compare offers from multiple suppliers. They request detailed quotes and check for hidden fees. Bulk purchasing often leads to better rates, so buyers should plan their orders in advance.

- Request samples to test product quality before committing.

- Negotiate long-term contracts for price stability.

- Monitor lead times to avoid production delays.

- Build relationships with suppliers for priority access during shortages.

💡 Tip: Buyers who stay informed about market trends can spot opportunities and avoid overpaying.

Risk Management

Market volatility can disrupt supply chains and impact budgets. Buyers must identify risks early and create backup plans. They should diversify their supplier base to reduce dependence on a single source. Regularly reviewing supplier performance helps spot issues before they escalate.

| Risk Factor | Mitigation Strategy |

|---|---|

| Price Fluctuations | Lock in prices with contracts |

| Supply Disruptions | Maintain safety stock |

| Quality Variations | Set clear product specifications |

Buyers who use these strategies protect their operations from unexpected shocks. They keep production running smoothly and control costs.

Partnering with Amazon Chemicals

Amazon Chemicals stands out as a trusted partner for Alkyl Ketene Dimer buyers. The company offers reliable supply, technical support, and market insights. Buyers who choose Amazon Chemicals gain access to high-quality products and responsive customer service. The team helps clients navigate market changes and manage procurement risks.

📞 Contact Amazon Chemicals today to secure your Alkyl Ketene Dimer supply and receive expert guidance tailored to your business needs. Buyers who partner with Amazon Chemicals position themselves for long-term success in a competitive market.

Staying informed about Alkyl Ketene Dimer market trends empowers organizations to optimize sourcing strategies and adapt to industry changes. Companies benefit from enhanced cost-performance ratios and improved product quality. Amazon Chemicals supports buyers with market intelligence services, including company profiles and complimentary updates.

- Customized support options and technical guidance help clients achieve reliable procurement.

Partnering with Amazon Chemicals positions businesses for success in a dynamic market. Reach out for tailored solutions that drive growth and resilience.

FAQ

What is Alkyl Ketene Dimer used for?

Alkyl Ketene Dimer improves paper strength and water resistance. Manufacturers use it in printing, packaging, and specialty papers. Companies choose AKD to meet high-quality standards and boost product performance.

How can buyers secure stable Alkyl Ketene Dimer prices?

Buyers lock in prices with long-term contracts and bulk orders. They monitor market trends and partner with reliable suppliers like Amazon Chemicals. This strategy helps control costs and ensures steady supply.

💡 Tip: Early planning and supplier relationships protect buyers from price spikes.

Why do companies prefer Amazon Chemicals for Alkyl Ketene Dimer?

Amazon Chemicals delivers consistent quality and fast service. The team offers technical support and market insights. Buyers trust Amazon Chemicals to manage risks and provide tailored solutions for their business needs.

What factors influence Alkyl Ketene Dimer market growth in 2025?

Strong demand for high-quality paper, sustainability trends, and regional industrial growth drive the market. Technological advances and new applications also boost Alkyl Ketene Dimer consumption.